The most innovative companies in food for 2024

Why J.M. Smucker, Driscoll’s, Chomps, and Scout are among Fast Company’s Most Innovative Companies in the food category.

This year, we daresay grocery shopping became a more complicated whole-brain task. Established brands still claim that fake ingredients are not hiding in their real products, while the disrupters continue to claim their fake products will trick you into thinking they’re real, and now the shelves feature new arrivals claiming their enhanced alt-products are back to more natural. Luckily, Fast Company’s Most Innovative Companies in food for 2024 offer some well-vetted prospects for weary supermarket-goers.

Adults professing their love of Uncrustables—the frozen, suddenly ubiquitous PB&Js—may be 2023’s least divisive cultural trend, one that allowed J.M. Smucker (No. 12 on this year’s overall list) to reestablish its roots as a simple sandwich-and-spreads brand. Fellow conglomerate Unilever made less of a game-changing product than a breakthrough for storing one of its top sellers: ice cream. It reformulated recipes to keep frozen treats at warmer temperatures, with the potential to cut its CO2 footprint by 30%. Driscoll’s leveraged its mastery of fruit breeding to mass-produce extra-sweet designer strawberries that retail for $4 per 10-ounce pack next to competitors selling six berries for $20.

Other brands redefined their category, such as Chomps, which makes sugar-free jerky from New Zealand venison and Cape Grim beef—among the planet’s highest-quality—and treats the animals and land with respect, not necessarily givens in an industry full of mystery-meat sticks and testosterone. Alec’s Ice Cream is the first to be certified regenerative organic, and the only sourcing 100% A2-protein milk, a variety sought by people with dairy sensitivities. After five years, Atomo Coffee released its long-hyped beanless coffee. The reverse-engineered mix of date pits, leftover tea, and lemon and sunflower seeds proved a big New York Coffee Festival hit. Scout, new in the Europe-centric world of conservas, found runaway success by loading its tins exclusively with North American seafood (Prince Edward Island mussels, rainbow trout, Canadian lobster) that you won’t find in the cans of category leaders like Ortiz and Jose Gourmet.

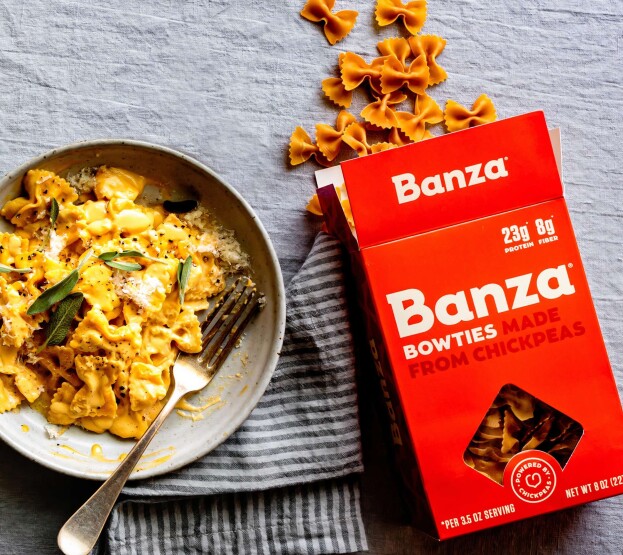

Once a category radical itself, Oatly introduced the first carbon-disclosure food labels this year and is using its brand penetration to push the whole food industry forward on voluntary emissions disclosures. Customers curious about the CO2e produced by their mixed-berry Oatgurts will find the answer (1.9 kilograms) printed on the packaging just like the calorie count. Veteran protein bar disruptor Kind Snacks and giant almond producer Ofi unveiled a 500-acre R&D farm to find a “kinder way” to grow the brand’s most-common ingredient. Meanwhile, the brand that introduced chickpea pasta to Americans—Banza—rolled out bucatini, a difficult shape for gluten-free, on its way to becoming America’s No. 5 pasta brand in 2023, joining the ranks of Barilla, De Cecco, and Ronzoni.